Umbrella insurance protects businesses from catastrophic losses by providing increased limits of liability for General Liability, Commercial Auto Liability, and the Employer’s Liability section of your Worker’s Compensation policy. It sits “over” these policies, picking up when the limits of each are exhausted.

Usually, the Umbrella policy provides the same type of coverage as these existing policies but in some cases can provide “drop down” coverage on something that is excluded from the underlying policy, such as Pollution and Professional Liability.

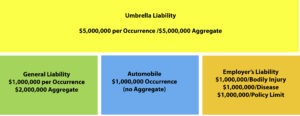

Here is a visual example of how it would usually apply:

What is typically excluded?

In most cases, the Umbrella policy exclusions mirror the policies they are supporting. Common exclusions include:

- Controlled Insurance Programs

- Cyber Liability

- Employment Practices Liability

- Inland Marine Liability

- Pollution Liability

- Professional Liability

- Property Insurance

How does this insurance fill a coverage gap?

In the case of a major claim, it does not take much to exhaust your insurance limits. An umbrella policy protects you should a catastrophic event occur. Without it, legal fees and awards could literally put you out of business.

What if the work is subcontracted?

Before your subcontractors step on the jobsite, they should sign an agreement that names your company as an additional insured on a primary and non-contributory basis. That means their insurance will respond first should a claim arise due to their negligence and the company will not seek contributions from your insurance carrier.

What are the implications of not having coverage?

Did you know that 1 in 5 workplace deaths occur on construction sites making construction one of the industries most likely to tap umbrella policies? Accidents happen even at the safest of construction companies and umbrella claims are happening more frequently.

It only takes one catastrophic event to trigger lawsuits and legal fees that will threaten your company’s survival. Think: a brick falls as a masonry contractor is working 12-stories high and strikes a pedestrian resulting in a fatality. An auto accident caused by your employee injures an entire family. A sprinkler head you installed goes off incorrectly damaging the 15 floors below and causing millions of dollars in damages.

It’s no wonder that many owners and general contractors require umbrella coverage to win a job.

How does a policy work and how long should you carry coverage?

This policy comes into play when the underlying policy limits it supports are exhausted. You must have the underlying policies — General Liability, Commercial Auto Liability, and Employer’s Liability – in place to secure Umbrella coverage. Umbrella policies renew annually and should be carried for as long as you are in business.

How do I get the right amount of coverage?

As claim costs continue to rise, a $1,000,000 umbrella policy may no longer be enough to cover the assets of your company. The most common limits are between $2,000,000 and $5,000,000. Higher limits may be necessary depending on the size of your operations, type of projects, geographic region and fleet. Coverage is placed on an annual basis and will need to be renewed 12 months after the initial purchase.

What happens if your business situation changes?

Your policy will need to match the growth of your company. As you expand the scope of your operations, your risk exposure expands with it and you will want to choose higher umbrella policy limits.